Perspective on Risk - June 14, 2023

Pettis; HK$ peg; Consultants; Family Office Capital Allocation; BRIC currency; Third Party Risk Management; Crypto Money Laundering; SF stuff

Thanks to everyone who gave during the charity drive. If you haven’t, but would still like to chip in, here is the link: HHRM Community Kitchen Giving Page

Pettis Commenting

Putting US Govt Debt Into Context

We often simplistically talk about the level of government debt as ‘good’ or ‘bad.’ Choices about the level of US debt is not just driven by our desires, but by the actions of other countries (China, Europe) and distributional concerns between producers and consumers. Pettis’ tweet stream does a very good job laying out the forces driving debt levels.

It's silly to think that the future rise in US debt will in any way be affected by debt limits. Rising US debt is just a way to counter conditions that have led to weak domestic demand. Indebted Demand

Both rising income inequality in the US and the US role running big deficits to absorb the mercantilist surpluses of its trade partners are different mechanisms that operate in the same way to reduce domestic consumption, either by forcing up...

domestic savings (inequality) or by forcing up the domestic absorption of foreign savings (the trade deficit). This happens in an economy in which the constraint on business investment is not scarce savings and expensive capital but rather weak demand.

One way the US can adjust to this weaker demand is to allow unemployment to rise. In that case the decline in workers' savings (unemployed workers have negative savings) balances imported savings and the rising savings of the rich.

Another way is to boost demand either by encouraging household debt to rise or by encouraging a larger fiscal deficit. Debt is negative savings, and so a rise in debt also balances imported savings and the rising savings of the rich. The Savings Glut Of The Rich

Obviously Washington prefers more household and fiscal debt over higher unemployment, and that is why debt must rise. As long as we are willing to accept high levels of income inequality and large trade deficits, this is the tradeoff we face. Why US Debt Must Continue To Rise

That is why if we really want to address surging debt in the US, we must reverse the policies that led to rising income inequality and we must limit the ability of foreigners to dump excess savings into the US. Debt limits are just a measure of legislative incompetence.

I would note one thing that he does not mention - he is talking about aggregate US debt; we could alternatively raise consumer and producer debt levels and cut government debt, but our foreign creditors will prefer the sovereign debt, though as the GFC showed, the private sector can manufacture ‘equivalent risk free assets’.

Yuan Depreciation

It is important to understand the drivers and constraints on macro forces. Structural effects in the long run dominate political desires. This Pettis tweet stream puts some context to why simply depreciating the Chinese Yuan will not sustainably lift their economy.

While the RMB may or may not depreciate further, a weaker RMB will most certainly not aid economic recovery. This widely-held belief is based on a misunderstanding of the Chinese economy and the way in which depreciation works.

A depreciation is basically a tax on importers and a subsidy to exporters or, to put it another way, a transfer from households (who are net importers) to manufacturers (who are net exporters). It works by increasing the business share of GDP at the expense of households.

The net effect is to push up the domestic savings rate at the expense of domestic consumption. In deficit countries, in which investment is constrained not by weak demand but rather by insufficient savings, a depreciation can boost domestic investment and spur growth.

In a surplus country like China, however, where investment is constrained by very weak demand, not by insufficient savings (which in fact are too high), depreciation only increases what China doesn't need and reduces what China urgently needs, i.e. more domestic consumption.

Clearly China doesn't suffer from weak exports. It's main problem is that domestic demand is stagnant. A policy that boosts exports at the expense of domestic demand may please exporters, but it will hurt overall growth in the economy and worsen domestic imbalances.

China's undervalued RMB, its repressed financial system, its labor restrictions, its massive overspending on business logistics and infrastructure, its weak social safety net, etc. are the reasons for its very unbalanced, high-savings, high-investment growth model.

This model worked well when China's was terribly underinvested in infrastructure and manufacturing capacity, but now that it has the opposite problem, i.e. excessive investment and insufficient consumption, it should be reversing, not reinforcing, these policies.

Hong Kong’s USD peg

Andy Xie was one of my favorite China watchers when he was at Morgan Stanley. I still like to read what he writes, the latest of which is Why Hong Kong must ditch the US dollar peg and switch to the yuan now.

Hong Kong’s currency peg to the dollar is not sustainable. The city risks being increasingly led by US monetary policy as the utility of the fully convertible Hong Kong currency in meeting China’s demand for US dollars is fading. As global yuan demand grows, switching to that currency would boost Hong Kong’s financial fortunes.

It is entirely possible for Hong Kong to switch to the yuan. The Chinese currency is not yet fully convertible but its offshore component is significant, at about 2 trillion yuan (US$283 billion). Foreign holdings of yuan bonds exceed 3 trillion yuan.

Beijing’s primary concern is its ability to control the yuan exchange rate. If the offshore component is too big, it may lose control. Given China’s foreign exchange reserves of US$3.2 trillion, and a current account surplus of over US$400 billion, adding Hong Kong to the offshore yuan world appears manageable. The yuan will become fully convertible one day anyway – a Hong Kong switch to the yuan could be a desirable transition.

Consultants

The Washington Post wrote a useful article titled McKinsey’s little-known role in the collapse of Silicon Valley Bank. Let’s parse this to discuss using consultants in risk management. (Some of my best friends are consultants; don’t @ me)

The article starts:

Three years before its epic collapse, highflying Silicon Valley Bank was preparing to join the big boys of the banking world as it neared $100 billion in assets. But SVB needed help to make the leap.

But the article goes on:

“Immediately they decided to hire consultants,” one former SVB employee recalled, speaking on the condition of anonymity to describe internal decision-making.

So the firm decided to:

“Plug the gap with consultants.”

“The consultants seemed to outnumber the FTEs [full-time employees],” the former bank official said.

Now one of the things I learned from Sid Sankaran is that there were three types of consultants:

Those hired strictly as staff supplement/replacement

Those hired for specific industry knowledge, say in IT or economic capital

Those hired for ‘transformational changes’ where a large part of the role is to help handle the internal political dynamics of getting everyone on the same page, and of convincing the Board that this is the right step to take.

It seems that SVB needed all three types. So they hired two firms, Curinos and McKinsey.

Curinos, [is] a small firm that specializes in banking.

Curinos … conducted a study of how interest rate changes could affect SVB’s deposits, a key variable in risk models. Rising interest rates can push people to move their money in search of higher yields. In April 2022, Curinos’s deposit study, along with SVB’s own analysis, led the bank to make “a poorly supported change in assumption” on what would happen to the bank’s deposits if interest rates rose — making it appear that this was a relatively safe strategy, although “no risk had been taken off the balance sheet,” according to the Fed report.

A quick look at Curinos website shows that they specialize in deposit pricing and analytics.

Now deposit sensitivity studies are typically used by banks to justify investing at longer maturities than those that would match the contractual maturities of their liabilities. Specifically, they analyze demand deposits to show that these balances tend to be insensitive to interest rate changes; the balances are presumed to be ‘operating cash’ and not ‘investment cash.’ And they probably are less sensitive normally, but this doesn’t factor in the risk of run when a firm’s solvency is questioned.

McKinsey, of course, is a “blue-chip management consulting group with a global roster of corporate and government clients.” Now McKinsey is a great firm if the primary goal is the third category of work listed above, but would not necessarily be the first choice for category #2. There it would very much depend upon the team that the various consultants are proposing to do the work - a number of them could do this competently, and I suspect McKinsey might be an expensive choice.

Here is how SVB and McKinsey described the scope of their work:

McKinsey said in a statement that it was hired by SVB for “a targeted assessment, geared specifically to the changes in criteria” as SVB crossed the asset benchmark for the nation’s largest banks, “not a comprehensive risk assessment.”

McKinsey was hired to identify gaps in SVB’s capital and risk management programs

So McKinsey was hired to perform a gap assessment and probably provide a roadmap to meeting the heightened regulatory expectations.

This is a classic place where consultants can help. Their staff often have former regulators and they see the different expectations and practices among firms of different size and complexity.

The Fed, however, was apparently quite critical of McKinsey’s work.

McKinsey’s work for SVB in 2020 and 2021 — which has not been previously reported — was sharply criticized by the Federal Reserve in its sweeping report on what caused the second-largest U.S. bank collapse since 2008. The Fed found that McKinsey had “failed to design an effective program” for assessing SVB’s problems and produced a report filled with “weaknesses.”

[It] stood out when, in late 2021, as the bank was updating regulators on its liquidity stress testing, one banking regulator asked the SVB team members if they thought they were getting their money’s worth from McKinsey, according to one former SVB official.

So it is a great article.

The first and most critical failure is that SVB did not have a sufficient number and quality of internal staff to perform routine Treasury and Risk Management activities:

The former SVB official recalled that a team of regulators on an early bank visit were stunned by the lack of employees, asking, “Where is the treasury staff? Where are the risk people?”

The second is that they likely did not have the needed employees to oversee the work of the consultants:

“The consultants seemed to outnumber the FTEs [full-time employees],” the former bank official said.

And finally, evidently, the lack of trust in McKinsey’s work led SVB to bring in yet another consultant:

After that, SVB turned to a different consulting firm to address the bank’s EPS gaps, according to the former SVB official. “They helped stabilize the situation.”

This firm is not named.

The key lessons here are that consultants CAN be very useful IF you get the right firm for the task, do not outsource activities where you should have internal expertise, and manage the consulting engagement appropriately. A lot of that did not seem to happen.

In Defense of the Second Line of Defense: The Role of Independent Risk Management

Family Office Capital Allocation

UBS has published their Global Family Office 2023 report.

The 2023 report comes at a defining moment in time, with the end of the era of low or negative nominal interest rates and the ample liquidity that followed the global financial crisis. Against that backdrop, our research shows family offices anticipating making major shifts in asset allocation.

Notably, they are looking to add to developed market fixed income holdings over the years to come and are already diversifying portfolios through high-quality short-duration fixed income. What’s more, family offices are planning to raise holdings in emerging market equities, following a perceived peak in the US dollar. Allocations to hedge funds have increased in line with a greater emphasis on active management, and they are planning to further diversify their private market allocations.

Reflecting the tense international environment, geopolitics is now the top concern for family offices. While they still have almost half of their assets in North America, they are planning to increase allocations to Western Europe for the first time in several years. Additionally, almost a third are planning to raise and broaden allocations to the wider Asia-Pacific region

LOL, no.

I don’t trade FX, but if you ask me, a currency created out of an old Jim O’Neil Goldman Sachs’ marketing strategy is not very likely to fly.

BRICS Nations Say New Currency May Offer Shield From Sanctions

BRICS nations asked the bloc’s specially created bank to provide guidance on a how a potential new shared currency might work, including how it could shield other member countries from the impact of sanctions such as those imposed on Russia.

The foreign ministers of Brazil, Russia, India, China and South Africa convened in Cape Town earlier Thursday to discuss how the bloc can win greater global influence and to challenge the US. While they didn’t reach firm conclusions, the use of alternative currencies was among the prominent talking points.

Third Party Risk Management

Interagency Guidance on Third-Party Relationships: Risk Management

Each of the agencies had previously issued their own guidance on managing third party relationships. They have now consolidated the guidance.

Relative to the Fed’s guidance, the guidance is much more specific and detailed.

Relative to the OCC’s guidance, which was probably the best of the three, the new guidance specifically discusses cloud computing providers, data aggregators, alternative data sources, third-party assessment services, and third-party models or model-related services.

Crypto Money Laundering

Most of the crypto stories these days bore me. Go read Matt Levine if you want to spend time reading a few thousand words.

However what does interest me is the connection to banking. We’ve always known that one of the primary use cases for crypto was money laundering. The NY Times has a nice article on how Binance Moved Billions Through Two U.S. Banks, Regulators Say:

In court filings, the S.E.C. accountant, Sachin Verma, detailed a tangle of transactions that companies associated with the giant cryptocurrency exchange had made through two banks: Silvergate Bank and Signature Bank, both of which failed this year. The filing showed that Binance officials, including the company’s founder and chief executive Changpeng Zhao, moved hundreds of millions and in some cases billions of dollars through the regional banks to accounts associated with companies in places like Kazakhstan, Lithuania and the Seychelles.

Banks are required to file with federal regulators a suspicious activity report, or SAR, when they suspect a transaction may involve money laundering or fraud. The reports are confidential but can provide investigative leads to the authorities.

“This is just so mammoth and should be raising red flags.”

Regulators did not say whether Silvergate or Signature reported the activities in Binance’s accounts. Silvergate, which voluntarily liquidated itself in early March after suffering billions of dollars in losses from its cryptocurrency customers, closed some of Binance’s accounts in 2021 and 2022.

Looking at the SEC filings against Binance, we find:

At inception, Zhao and Binance had control of BAM Trading’s bank accounts. They even coordinated with BAM Trading’s first CEO (named “BAM CEO A” in the Complaint) to set up bank accounts in a way that allowed Binance and thus Zhao to retain control while avoiding scrutiny from U.S. regulators. Specifically, in November 2019, BAM CEO A asked Binance’s CFO why Binance had instructed her to have a “non-US resident non-employee on the bank applications” because it “will be a red flag for regulators and will open .com to US scrutiny,” while also acknowledging “there is not that much separation internally” between Binance and BAM Trading. Ex. A-64. Ultimately, she followed Binance’s direction, and a Binance employee had control over all of BAM Trading’s accounts at that time.

If you recall the FDIC’s post mortem review of Signature Bank, you’ll recall that:

The Federal Deposit Insurance Corp. was preparing a consent order against Signature Bank for “apparent violations” of U.S. sanctions and anti-money laundering rules before the lender closed down in March.

Eight (8) of the 13 total “matters requiring board attention” that surfaced during federal examinations of Signature in 2022 flagged shortcomings with the lender’s AML program.

Even if it wasn’t the prima facia reason for the closure of Silvergate and Signature Banks, I’m sure the regulators are not upset.

What I Listened To On My Flight To SF

Only for my systemic risk nerds

Kindleberger and the 21st Century Perry Mehrling Bob McCauley are two of the most eminent scholars of Kindleberger. Kindleberger is most known for writing Manias, Panics, and Crashes: A History of Financial Crises, a classic of central banking and risk management.

McCauley talks about his update for the 8th edition of Manias, and the huge changes that needed to be brought out (Fed as International Lender of Last Resort, Fed support of corporate securities market through outright purchases).

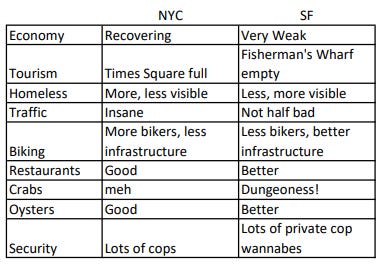

NYC vs, SF (one man’s observation)

Highly recommend having dinner at BIX if you’re in town.

Thank you, great post and insights re McKinsey & SIVB

Two quick thoughts on Pettis. Higher debt is not just about reduced demand, It is also especially attributable to higher medical spending deriving from Medicare and Medicaid, each of which has contributed to absorbing increasing shares of government revenues. Second, Ragharam Rajan articulated a good summary of your point about alternatives to sovereign debt; it was AAA mortgage debt during the GDC. See his book "Fault Lines", perhaps the best book on the causes of the GFC.