Financial Stability Conference

Yesterday I attended the Market Microstructure and Financial Stability: Is there a Link? symposium organized by Jain Family Institute (JFI) and the Yale Program on Financial Stability (YPFS), hosted by the Volatility & Risk Institute at NYU Stern. Quite interesting. Saw several Fed alum while there (as is usual at these things).

The conference was under the Chatham House Rule, so I can give you a sense of the discussion and my reaction and thoughts without attributing remarks. There was no formal press coverage allowed.

Private Credit

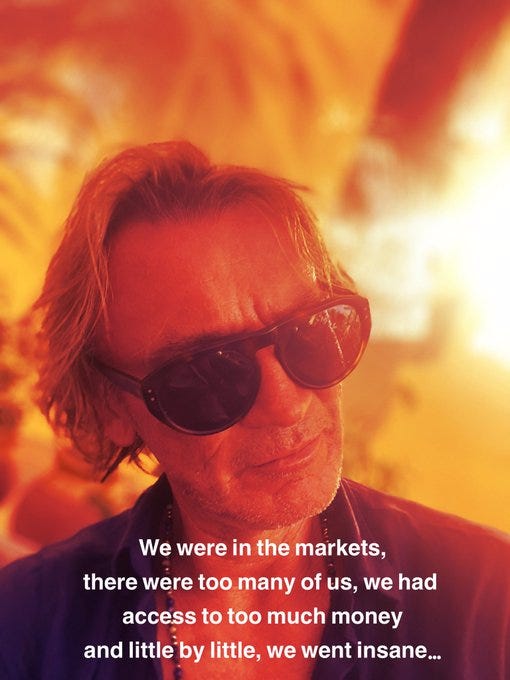

The discussion on private credit started as many of these do, with participants citing all of their virtues. It is relationship lending, with specialized expertise, conservative, low-leverage, blah, blah, blah. You know how it goes.

What struck me was that this was just business that was done in the early 1990s by banks such as Chemical, Chase, First Chicago, Fleet, Regions, even Citibank. There was nothing particularly new here other than the lending being done outside of the regulatory perimeter. Maybe consolidation has led to the bank’s loosing focus, but I doubt it if they have the proper economic incentives.

So it’s clear that changes to the capital rules have changed how this market operates.

So the next question is whether it is less risky?

We discussed how banks were now significant players taking the senior tranche of the structures, which themselves operate with 2-4x leverage.

So we have banks that previously operated at 10-12x leverage before the capital rules now operating at 8x leverage, but investing in structures with 3-4x leverage. Overall leverage seems unchanged. But we now have a layer of uninsured, unregulated capital in the structure. This is probably a positive development.

But one cannot escape the analogies to subprime with banks holding the super-senior position. There is no mis-rating by the rating agencies because these are unrated, and we don’t know if there are incentive issues like we saw in the origination and securitization chain. Don’t know whether there are any of the “liquidity put” type structures that burned Citi (among others).

There were two other troubling analogies. Right up front, in discussing the specialized underwriting expertise, it was stated that in some cases up to 70% of EBITDA may be fake. Add-backs and adjustments. Sure sounds like liar loans.

The other aspect was that when asked what investors were most looking for in the development of private credit, the response was “liquidity.” So in one breath, the lock-up period for investors was cited as a product strength, and in the next breath we heard of structurers trying to find ways to give investors quicker redemption windows. Hmm.

Add to this the desire to develop ETF products in the space to attract retail investors.

One other analogy is clear; the extended settlement period for bank loans is hardly robust enough to support trading; a clear possible repeat of the single-name CDS issues.

Inefficiencies In Treasury Market Hedging

The second session was on the Treasury markets. Two forces have come together to create issues; post-GFC reforms to strengthen bank/dealer balance sheets, and an expanding Treasury issuance calendar.

Simply put, dealer capacity shrank with higher capital requirements, and now Treasury issuance is growing faster than dealer balance sheet capacity. This is having several effects:

The post-GFC reforms have driven the creation of the US basis trade.

Increased market volatility. But it is a bit strange according to market participants; long periods of low volatility with occasional days of higher volatility driven by repo liquidity (at least that was my interpretation).

Participants claim that it is making it harder for market participants to obtain cash (through repo) in a crisis.

There was a lot of discussion about the scope and benefits of central clearing, but I didn’t see much to add here.

One other thing was clear; we are still not back to normal markets. When asked if there was sufficient liquidity to allow the Fed to unwind its mortgage security holdings, the general response was no (for a variety of technical reasons).

Interest Rate Swap’s Role In Short Term Funding

Interesting discussion on the SOFR swap market, and the problems of market segmentation, but I only had one takeaway from this session (and it relates to the next topic).

Evidently, though it is early, there is talk about an emerging “stigma” with dealer firms using the Fed’s Standing Repo Facility (SRF) to arbitrage markets to keep the repo rate in the corridor that the Fed desires. The design of the Fed’s current policy regime is that the Discount Window rate creates a floor on the rate while the SRF creates a ceiling. It seems dealer firms are questioning whether they want the headline risk to earn a few bp.

Payment Systems Design

While I think the moderator may have wanted to discuss the future of the payment system, including tokenization, the discussion rapidly turned to the Discount Window stigma, the FHLB’s role, the role of market discipline, and the tension between high frequency trading and extended settlement periods.

What became most clear to me throughout the discussion is that there really is no way for the Fed to destigmatize the DW. There was talk of ways to encourage firms to use Fed Primary Credit (which is designed for non-problem firms), but I can’t see this working - we still have an information problem.

Take a hypothetical where there is no FHLB involvement in funding and banks regularly tap Primary Credit; what happens in a case like SVB? At year-end, when SVP is in compliance with regulatory capital rules, but perhaps economically insolvent due to unrealized losses, does the Fed extend Primary Credit? Or force it into Secondary Credit?

In some ways, we have a working system, even though we all seem to hate it:

Healthy firm → Regular Funding → Market

Stressed firm → Stressed Funding → FHLB System

Failing firm → Lender-of-last-resort → Fed Discount Window

Now if we eliminate the FHLB, maybe there is incentives for regulators to resolve firms earlier.

Anyway, those were my takeaways. Thanks to Steve Kelly at Yale for extending the invite.

Basel III

Take the over

Glastonbury

Always love finding some new things to listen to. All are Youtube links.

Sugababes - About You Now (Glastonbury 2024)

Lankum - Bear Creek (Glastonbury 2024) - alt country?

Burna Boy - Last Last (Glastonbury 2024) - African hiphop

Masego - Old Age (Glastonbury 2024) - rap singalong

Little Simz - Gorilla (Glastonbury 2024) - rap Queen

Mdou Moctar - Imouhar (Glastonbury 2024) - guitar rock

Psychedelic Porn Crumpets - Hymn For A Droid (Glastonbury 2024) - metalish

Steel Pulse - Steppin' Out (Glastonbury 2024) - reggae

Jungle - Keep Movin' (Glastonbury 2024) - pop