Perspective on Risk - July 17, 2023

We Need To Talk About China; Fiscal Dominance; Commercial Real Estate; Bank Regulatory Reform; Fed Looks At Crypto; Reading

We Need To Talk About China

Is China facing debt bomb at home? (Times of India)

China, which has lent nearly $1 trillion to some 150 developing nations, has been reluctant to cancel large debts owed by countries struggling to make ends meet. That is at least in part because China is facing a debt bomb at home: trillions of dollars owed by local governments, their mostly off-the-books financial affiliates, and real estate developers. Researchers at JPMorgan Chase calculated last month that overall debt within China — including households, companies and the government — had reached 282% of the country’s annual economic output. That compares with an average of 256% in developed economies around the world and and 257% in the US.

China’s Economy Is Sputtering

China’s Drop in Exports Signals Deepening Slowdown in Global Trade (WSJ)

Exports are crumbling in China and across Asia, showing the deepening toll that rising interest rates are taking on global trade and economic growth.

China’s exports to the U.S. fell 24% in June compared with a year earlier. Shipments to the European Union sank 13% and sales to the Association of Southeast Asian Nations, a group of 10 countries that includes Indonesia and Malaysia, fell 17%.

China Slides to Brink of Deflation, Adding Stimulus Urgency (Bloomberg)

China’s consumer inflation rate was flat in June while factory-gate prices fell further, fueling concerns about deflation risks and adding to speculation about potential economic stimulus.

Zero consumer price inflation and deeper falls in producer prices in June suggest China’s post-covid rebound has lost more steam. Flagging momentum on the price front is a sign of weak demand that clouds the growth outlook. The need for more stimulus from the People’s Bank of China is rising.

It Is Only Marginally More ‘Open’ Than In 2010

Where Does China’s Economy Stand? (China Pathfinder)

Richard Koo Says China Is Facing A Balance Sheet Recession

Inventor of ‘Balance-Sheet Recession’ Says China Is Now in One (Bloomberg)

Koo’s concept … defines a balance-sheet recession as a situation in which households and businesses divert more of their income toward paying down debt, rather than consuming or investing. Koo argues that was a key reason for Japan’s descent into deflation, and for the slow US and European recoveries from the 2008 financial crisis.

In China, evidence is seen in a slump in mortgage borrowing, decline in house prices and reluctance among private sector companies to borrow and invest. Inflation has fallen close to zero this year — another sign of weak demand in the economy.

The government needs to step in as a borrower-of-last resort to maintain spending that then provides households and business with income they can use to repair their balance sheets, until they are confident enough to resume borrowing.

“If the government puts in speedy, sufficient and sustained fiscal stimulus, then there’s no reason for Chinese GDP to collapse,” he said.

China has space to expand government borrowing so long as private-sector savings remain high, he argued. However, “debt is already large, and you have to expand it to offset all the deleveraging that is going to take place — that could put some pressure on the Chinese financial market.”

Richard Koo on China’s Risk of a Japan-Style Balance Sheet Recession (OddLots transcript)

There's also a big difference between the Chinese situation and the Japanese one. And that is that Chinese are already very much aware of this risk called balance sheet recession. And 30 some years ago when this thing was happening in Japan, no one in Japan, including myself, had any idea about this balance-sheet recession

Once you know that this is a recession which is produced by lack of borrowers, and the borrowers are not coming into borrow money because they have balance sheet problems, so the private sector themselves cannot change their behavior -- after all, they're doing the right things: trying to repair their balance sheets -- then the government has to come in and borrow and put that money back into the income stream, which means fiscal stimulus is absolutely essential once you're in balance sheet recession.

My guess is that Chinese government will put in the fiscal stimulus, which they're actually quite good at, and that will keep the recession from turning into a depression

The federal government or the central government probably has plenty of room left to borrow and spend.

I would recommend Chinese government to go in there and help those construction companies so that all the promised construction will be actually completed. I think that will be the most effective way to spend fiscal stimulus, fiscal money. Because that way those people who were feeling very insecure … will at least get the apartments built ...

One key difference between the Japanese and the Chinese situation is that construction is such a large part of Chinese GDP. Construction accounts for something like 26% of Chinese GDP, whereas during the bubble days in Japan it was only around 20% and it wasn't a big part of the picture.

So Far, The Reaction Function Has Been Weak

George Magnus writes The Chinese economy after the ‘Two Sessions’ (Council on Geostrategy)

The CCP’s focus on financial stability in the face of deep-seated problems in the real estate sector and in local governments seems to be firm, and there has been no embrace of large-scale economic stimulus.

Recurring bouts of instability suggest other factors are also at work, such as the effect of financial repression and low interest rates leading to the misallocation of capital, the underpricing of risk because of implicit state guarantees, and poor interventions.

NY Fed Suggests China Is Running Low On Options

Is China Running Out of Policy Space to Navigate Future Economic Challenges? (Liberty Street)

In this post, we revisit China’s debt buildup and consider the growing constraints on Chinese policymakers’ tools to navigate future economic challenges.

While other major economies in the world are now tightening their monetary policies, expectations are for overall debt in China to rise again in 2022 to stabilize growth. China’s repeated reliance on credit-driven stimulus raises questions about the buildup of risks in the financial system and the extent to which rising debt levels in all three sectors—discussed below—are sustainable and could ultimately hamstring Chinese authorities’ policy options.

Borrowing by the corporate sector—the largest part of China’s total debt—is equivalent to approximately 153 percent of GDP, a figure that is among the highest in the world.

Household debt accounts for 62 percent of GDP in China and has grown rapidly in recent years…. China’s household debt has risen to levels that are quite high by developing country standards but remain broadly comparable to those of developed economies.

Officially recognized central and local government debt in China is moderate by international standards, at about 50 percent of GDP. However, estimates of “augmented” fiscal debt are much higher, at up to 100 percent of GDP for year-end 2021, according to IMF estimates.

There are strong reasons to be watchful for signs of a sustained downshift in China’s historical pattern of economic performance.

First, there is evidence that China’s credit-driven growth model is facing serious diminishing returns

Second, fiscal and monetary policies appear to face political and institutional constraints that may not be readily apparent from the data.

Finally, China faces other important challenges … China’s demographic profile is aging quickly, which will greatly increase old-age dependency and lead to a reduction in the working population. Moreover, as its share of global trade stops rising, China’s export engine eventually will downshift to a growth rate similar to that of world trade, or perhaps even lower.

China Has Been Bailing Out Belt-And-Road Countries

Carmen Reinhart et. al. have written an interesting analysis China as an International Lender of Last Resort . From the introduction (rather than the abstract) to their paper:

Following a more than decade-long boom in overseas lending and investment, China’s Belt and Road Initiative (BRI) has come under pressure, as many recipient (debtor) countries in the developing world experience financial distress.1 It has already been documented that Chinese state creditors have responded to this crisis by reducing new overseas lending flows to the Global South and by negotiating dozens of sovereign debt restructurings (Horn et al. 2022b, 2023). What is less well understood and of more recent vintage is the large and rising number of Chinese bailouts to countries in distress over the past 15 years.

One of the authors, Christoph Trebesch, has an excellent tweet stream discussing the paper. They show China’s international lending has two pillars:

The first pillar is the global swap line network created by the People’s Bank of China. Officially, the purpose is to foster trade and investment in RMB. We… find that this money is actually going to crisis countries in distress

The second pillar are classic, bilateral rescue loans, meaning balance of payment support from Chinese state-owned banks (>70 billion USD). We also identify indirect bailouts to crisis countries by Chinese state oil & gas companies, which provide large cash advances

For Those Who Want To Go Deep

You may want to revisit Document 9: A ChinaFile Translation

One such signal came during this past [2013] spring, when reports began to appear that the Party leadership was being urged to guard against seven political “perils,” including constitutionalism, civil society, “nihilistic” views of history, “universal values,” and the promotion of “the West’s view of media.” It also called on Party members to strengthen their resistance to “infiltration” by outside ideas, renew their commitment to work “in the ideological sphere,” and to handle with renewed vigilance all ideas, institutions, and people deemed threatening to unilateral Party rule. These warnings were enumerated in a communiqué circulated within the Party by its General Office in April, and, because they constituted the ninth such paper issued this year, have come to be known as “Document 9.”

Fiscal Dominance

I have written about financial and fiscal dominance and the effect on monetary policy options. The fiscal dominance concerns are starting to be raised as the Fed pledges to remain ‘higher for longer.’

US Racks Up $652 Billion in Debt Costs as Rates Hit 11-Year High

The cost of servicing US government debt jumped by 25% in the first nine months of the fiscal year, reaching $652 billion and contributing to a major widening in the budget deficit.

For the nine months through June, the federal deficit hit $1.39 trillion, up some 170% from the same period the year before, according to Treasury Department data released on Thursday.

The BIS is out with warnings about the possible risks: Monetary and fiscal policy: safeguarding stability and trust, and takes a longer-term perspective. This is a really good central banker discussion that, of course, does not call out any particular country.

In recent decades, monetary and fiscal policy gradually moved towards the boundaries of the stability region, as they were often relied upon as de facto engines of growth. This has set the stage for the current tensions between them, as well as for the macroeconomic and financial risks ahead.

Policy adjustments and institutional safeguards are needed to ensure that the two policies remain firmly within the region of stability. These hinge on a keener recognition of the limitations of macroeconomic stabilisation policies.

The recent challenge to the boundaries is the latest in a long journey that stretches back to at least the 1970s. At each point in time, the policy choices seemed reasonable, even compelling. But cumulatively, they pushed the policies towards the boundaries. The root cause of the drift has been a tendency for policymakers to succumb to a kind of "growth illusion", ie an overly optimistic view about the ability of macroeconomic stabilisation policies to sustain economic growth.2

Instability in the wake of overstepping the boundaries of the region of stability can take different forms. Common manifestations include high inflation, economic slumps, sovereign default and financial stress. A sharp depreciation of the exchange rate is a typical symptom and transmission channel. The most acute manifestation of drifting far outside the boundaries is hyperinflations, such as those experienced in some Latin American emerging market economies (EMEs) in the 1980s and 1990s.

Pettis tweet streamed some comments on the US fiscal position (summarized):

Rising US debt is indeed a problem, but the way to resolve it isn't by cutting back on government spending, and it certainly isn't by cutting back on government investment. The real way to resolve it is by reversing income inequality.

Income inequality reduces domestic demand by transferring income from high consumers (ordinary Americans) to low consumers (the rich). Supply-siders will argue that the reduction in consumption is balanced by a rise in investment funded by the higher savings of the rich.

But that isn't happening. American businesses aren't constrained by scarce savings so much as by scarce demand, so that more ex-ante savings does not lead to more investment.

That's why the reduction in consumption must be reversed or it must lead to a rise in unemployment.

There are basically two ways Washington can reverse the decline in domestic demand. One way is for the government to run fiscal deficits, and the other way is for the Fed to encourage household debt, so that consumption is supported by higher debt rather than higher wages.

This is basically what Washington has done, and so it is not just a coincidence that sharply rising household debt and rising fiscal deficits have characterized the US economy since the late 1970s, just as income inequality began to rise sharply.

Until the underlying problem of income inequality is fixed, those who demand that the US reduce its fiscal deficits are in fact demanding either that the Fed encourage even more household debt, or that US unemployment should rise.

Marriner Eccles made this very point in the 1930s: the more income is concentrated, the more we require rising debt to prevent rising unemployment, and once debt can no longer rise, as happened in 1930, the alternative is a surge in unemployment.

Those who want fiscal "responsibility" without addressing the underlying reasons debt must rise are basically making the same argument that Herbert Hoover made in the early 1930s.

Commercial Real Estate

Out of Office: Where Real Estate Markets Stand Today (Marquette Associates)

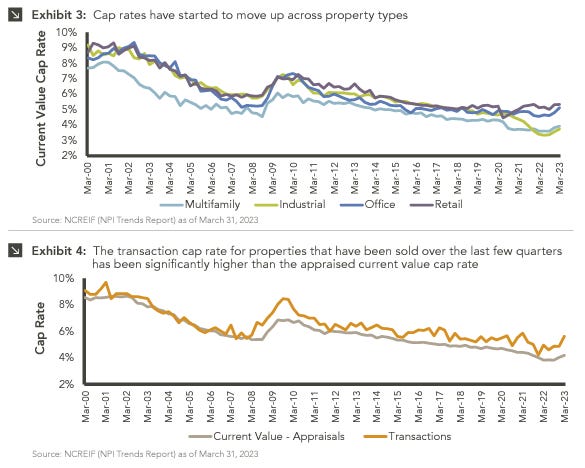

valuation metrics like discount rates and exit cap rates have moved up, driving appraised values lower across the majority of the core real estate universe

Private real estate entry points emerging amid selloff (Cohen & Steers)

Private real estate transaction volume has plummeted, and performance has lagged listed real estate for a second consecutive quarter. We expect significant repricing to create favorable entry points for investors – but these will demand judgement and selectivity.

We expect valuations to decline in the area of 20% overall, but this will vary across property types. The weakest properties (older properties in gateway coastal markets) will be hit hardest and the strongest properties (newer, amenity laden real estate in sunbelt locations) will be the most resilient.

Repricing is just getting underway with the weakest assets and capital structures failing first. Coastal, gateway office properties, for one, are on the leading edge of distress. In fact, some of the largest CRE asset managers in the industry have defaulted on billions of dollars worth of offices in New York and Los Angeles, two of the weakest gateway cities.

Indeed, 16% of CRE loans will mature in 2023, of which office is the largest at 26% of that figure, followed by multi-family. From there, another 15% is maturing in 2024. As a result, pockets of distress will appear in the coming months. We do not believe this presents a systemic risk and will certainly not reach the depths of the GFC as fundamentals are on stronger footing while lending standards are much more conservative.

Financial storm bears down on US commercial real estate (FT)

One broker estimated that only the top 10 per cent of office buildings in New York were not distressed — either in terms of the level of debt or occupancy.

The financial damage may be masked because so few buildings have been sold in the past year, with deal volumes for commercial real estate down by more than half year on year in the first quarter, according to CBRE. That means that many owners have not been forced to update their valuations.

Real Estate Is Most Distressed Sector in Europe, Study Finds

Real estate was the most distressed sector in Europe in the second quarter of the year, driven by rising pressure on liquidity, softer investment metrics and squeezed profitability.

Bank Regulatory Reform

Measures to prevent runs on solvent banks (VoxEU CEPR)

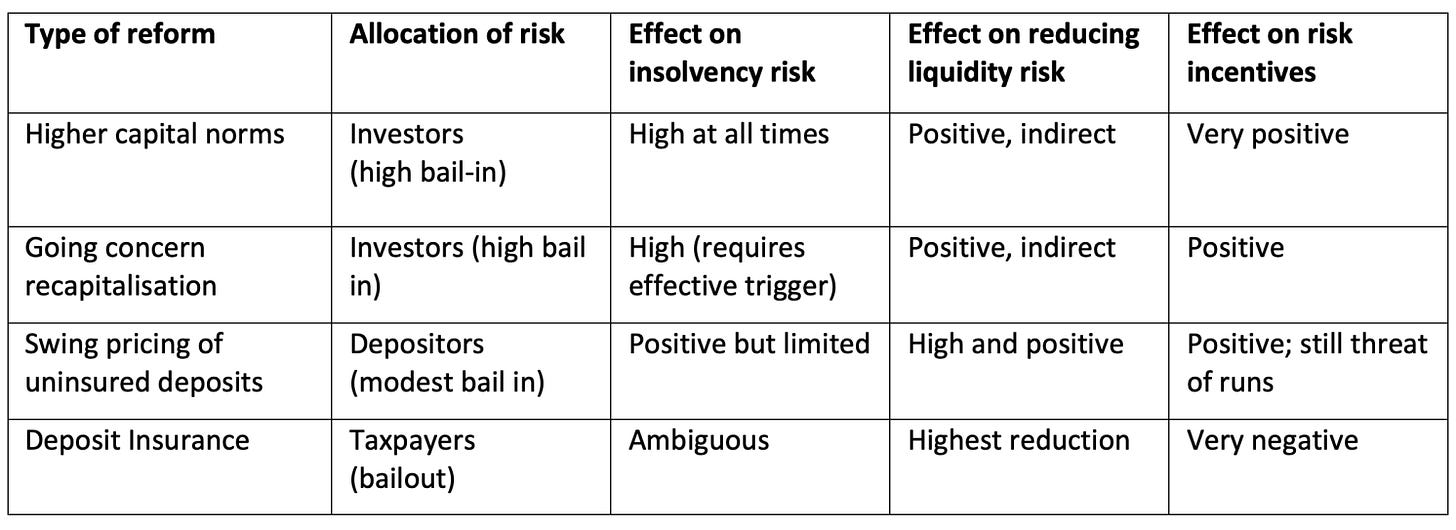

The experience calls for norms aimed at strengthening uninsured deposit stability, specifically to prevent solvent intermediaries from defaulting when withdrawals turn into a self-fulfilling run.

Ex-ante solutions include extending deposit insurance and raising bank capital. Contingent solutions would strengthen risk absorption to prevent run escalation into default. Each of these options affect run incentives by allocating risk, either to taxpayers, investors, or uninsured depositors. The key policy issue is how to allocate risk efficiently while limiting endogenous risk taking.

An extreme option would eliminate risk by narrow deposit banking, a variant of government money market fund.

A radical option is to suppress runs by wide guarantees for most bank demandable debt, well beyond insured household deposits.

A natural solution is to vastly increase private risk absorption capacity, forcing more bail-in capital so that uninsured depositors are paid even in a default and do not need to run.

Dudley: More Deposit Insurance Won’t Make Banks Safe

What’s needed is a backstop that creates the proper incentives for banks to manage risk. With this in mind, I would propose an expansion of the Federal Reserve’s lender-of-last-resort function (along the lines of a mechanism proposed by Mervyn King, who headed the Bank of England during the 2008 financial crisis). Instead of offering a blanket guarantee, the Fed would promise to lend banks the money needed to pay all their uninsured depositors — but, in exchange, banks would have to pledge sufficient collateral to cover those deposits.

Hey, if anyone knows Bill’s email, send him my post from May: Perspective on Risk - May 19, 2023 (Bagehot is out of date)

Help Wanted: Retired Bank Examiners to Unravel Bond Mess (WSJ)

Doubt they can afford me anymore, but hey Dianne, I can always consult.

The Fed Looks At Crypto

I haven’t read these - crypto bores me.

Runs on Stablecoins (Liberty Street)

In May 2022, there was a run on Terra, an algorithmic stablecoin whose price broke its peg of $1 and crashed to zero. The run spilled over to the entire stablecoin sector, with stablecoins backed by riskier assets heavily affected and investors fleeing to less risky U.S.-based stablecoins regulated by U.S. authorities. As the digital asset ecosystem continues to grow, its potential to affect traditional financial markets and a broader section of households and firms could grow accordingly.

Interconnected DeFi: Ripple Effects from the Terra Collapse (FEDS)

We outline a generalizable economic theory of blockchains which aims to differentiate the economics of blockchains as programmable environments from blockchains as accounting ledgers for crypto-assets. … We test several implications of this theory using Terra’s collapse as a natural experiment, finding evidence that bridges between programmable blockchain networks create increased risk of spillover effects to other blockchains’ programmable environments in the wake of a major shock event like Terra’s collapse. Specifically, blockchains suffered a time-bound loss of market share and the likelihood of this loss grew approximately 40% for each additional bridge that was deployed in common with Terra at the time of Terra’s collapse.

Reading

When Should You Deviate From the Base Rate?

If you ask an experienced forecaster for guidance, one of the first things they’ll tell you is to consider the base rate. The base rate is a measure of how prevalent an occurrence is in a certain population: how common a trait is in a group of people, or how frequently an event has occurred in the past over a certain period of time, for example.

The evidence suggests that using base rates is correlated with better forecasting accuracy. So one should be very careful when deviating too far from the base rate.

The key question to ask is whether the underlying conditions have changed dramatically.

COMPOUNDING MATERIALIZES THE IMPORTANCE OF DIVERSIFICATION

Conventional diversification analysis focuses on annualized standard deviation of arithmetic returns, but long-term investors eventually care about compound terminal wealth. When we focus on terminal wealth, we find that many conventional wisdoms concerning diversification no longer hold. Or that new aspects – absent from conventional diversification effect analysis – arise.

We find that, in the absence of stock picking skill, the importance of diversification increases as time horizon increases, that diversification becomes particularly important when allocation to stocks increases or when we leverage our portfolio and that importance of diversification depends on our selection of investing style.

To prevent our randomly selected equally weighted portfolio’s relative terminal wealth difference to fully diversified benchmark from decreasing and probability of losing to benchmark from increasing, we need to increase diversification in direct proportion to time and in squared proportion to leverage multiplier.

I don’t claim to have superior stock picking skills, so for the majority of my portfolio I focus on diversification.

Quant hedge fund primer: demystifying quantitative strategies

In this piece we explore quantitative investing and provide insights into the most common quantitative strategies. For each of the quantitative strategies we provide a description, we discuss common signal types and look at how each strategy historically performs in different markets and its historic risk and return profile.

Using GPT-4 for Financial Advice

We show that the recently released text-based artificial intelligence tool GPT-4 can provide suitable financial advice. The tool suggests specific investment portfolios that reflect an investor’s individual circumstances such as risk tolerance, risk capacity, and sustainability preference. Notably, while the suggested portfolios display home bias and are rather insensitive to the investment horizon, historical risk-adjusted performance is on par with a professionally managed benchmark portfolio. Given the current inability of GPT-4 to provide full-service financial advice, it may be used by financial advisors as a back-office tool for portfolio recommendation.

Aggregate Implications of Deviations from Modigliani-Miller: A Sufficient Statistics Approach (FEDS)

A few sufficient statistics can identify the aggregate effects of distortions to firm investment in a class of general equilibrium models that can accommodate rich general equilibrium effects including endogenous firm entry. This result does not depend on the microfoundation of the distortion; one can generate inferences about aggregate effects that apply for multiple microfoundations or in cases where a fully specified model is difficult to solve. To demonstrate the relevance of the methodology, we use it to quantify the aggregate consequences of costly external equity financing and a manager-shareholder friction, relying on estimates from the corporate finance literature to identify the sufficient statistics. The results elucidate differences between partial and general equilibrium findings and demonstrate how labor supply elasticities, complementarities in production, and firm entry interact with the different firm-level distortions.