Perspective on Risk - Jan 22, 2023

Too Big To Manage; Recession Signaling; Disappearing Japanese Bid; Geopolitical Risk; Balding; Pettis; Productivity & Compensation; Southwest; Cybersecurity; Things

I have a bunch of things in the hopper that require longer gestation. No ‘big thinking’ this week - just normal risk manager things (and snark).

Too Big To Manage

OK, wow. Acting OCC Comptroller Michael Tsu, who I knew from the Lehman crisis, made an interesting, and clearly provocative speech at Brookings: “Detecting, Preventing, and Addressing Too Big To Manage”

In the speech, he lays out nicely the signs that an institution may just be too damn big:

The (im)materiality illusion

The isolated incident/bad apple illusion

External versus internal risk identification.

Hubris, contempt, and indifference

Rushed integration and diseconomies of scale

As a former supervisor, and as a risk manager, I have seen each of these play out numerous times.

What is MOST interesting about the speech is brought up in the introduction, and again in an entire section towards the end.

There are limits to an organization’s manageability.

Enterprises can become so big and complex that control failures, risk management breakdowns, and negative surprises occur too frequently – not because of weak management, but because of the sheer size and complexity of the organization.

And most especially:

The most effective and efficient way to successfully fix issues at a TBTM bank is to simplify it – by divesting businesses, curtailing operations, and reducing complexity. Other, more typical, actions, such as changing senior management, increasing remediation budgets, developing better plans, and hiring more risk and control function personnel will have limited impact at a bank that is TBTM. It is the size and complexity of the bank that is the core problem that needs to be solved, not the weaknesses of its systems and processes or the unwillingness or incompetence of its senior leaders.

He went there, and as an Acting Comptroller. I don’t know if this is just political pandering, but he went there. This is not something I’ve ever hear senior leadership say.

He then laid out a four-step escalation framework.

the design logic of an escalation framework is to use the credible threat of restrictions and divestitures, guided by and consistent with due process, to force banks to prove that they are manageable and to then let the effectiveness or ineffectiveness of their actions speak for themselves.

At the first level, a bank under normal circumstances is put on notice and the nature of the weakness requiring remediation is made clear. Situations vary, but generally this starts with an MRA, which is a non-public supervisory finding typically stemming from an examination.

Significant deficiencies and/or weaknesses that go unaddressed can escalate into public enforcement actions, such as a consent order, where material safety and soundness risks or violations of laws and regulations are at play.

[A] restriction on growth, business activities, capital actions, or some

combination may be warranted in order to incent corrective action and serve as a compensating control pending effective remediation.

[I]f a bank, after being publicly reprimanded and constrained in some way, continues to violate the law or drags out remediation timelines … evidence of the bank’s inability to manage itself would become overwhelming and supervisors would consider the fourth level of escalation – simplification via divestiture – what some refer to as “breaking up the bank.”

My only problem with this framework is that it will likely take too damn long. This is probably an outlier opinion among supervisors, as in general we do not want to impose our judgment for that of the bank’s Board and shareholders except in rare cases where safety of the financial system is at stake.

Timing is also very interesting. One would imagine the OCC making this statement perhaps once they had lifted the growth restrictions on Wells Fargo (I believe the 2018 restrictions are still in place, correct me if I’m wrong). They must have confidence that Wells is on the right path; wouldn’t want my firm to be in one-and-done status.

Recession Signaling

New Fed Board paper, Recession Signals and Business Cycle Dynamics: Tying the Pieces Together, presents an interesting paper that looks at recession prediction models. Concludes that combining financial and economic variables is superior to either alone.

Examining a parsimonious, yet comprehensive, set of recession signals yields three lessons.

First, signals from financial markets, leading indicators of activity, and gauges of the macroeconomic environment are each useful at different horizons, with leading indicators and financial signals informative at short horizons and the state of the business cycle at medium horizons.

Second, approaches emphasizing the yield curve overstate the recession signal from the term spread if other factors are not considered; given correlations among indicators, these differences are often small, but were large in 2022.

Finally, simulations of a reduced-form vector autoregression of unemployment and financial conditions, which captures the time-series properties of the series well, suggest the patterns are consistent with a typical hump-shape characterization of business cycle dynamics; this synthesis tightens the connections of the recession prediction literature with the business-cycle literature.

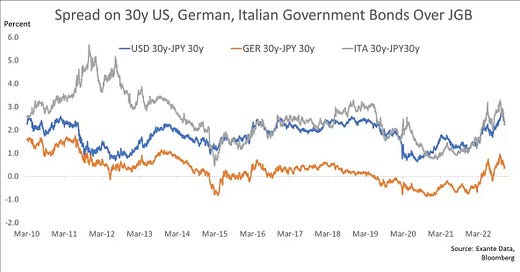

The Disappearing Japanese Bid for Global Bonds

Brad Setzer and Alex Etra have written a nice primer, The Disappearing Japanese Bid for Global Bonds, to ‘demystify’ the nature of Japanese flows. The whole piece is worth reading as they go through each of the different types of Japanese financial institutions, and broadly their strategies and incentives.

The rapid rise in short-term U.S. interest rates relative to long-term interest rates—and now the inversion of the U.S. interest rates curve—have made it unprofitable for Japanese investors to borrow dollars in the short-term (including through the swaps market) and buy safe U.S. government bonds. In fact, by the end of 2022, it wasn’t even attractive to buy currency-hedged U.S. investment-grade bonds.

The truly catastrophic scenarios for the global market would likely require a large acceleration of these sales, and the rapid unwinding of the $2 trillion plus foreign bond portfolio that Japanese institutional investors still hold. Such an unwind would likely stem from the intersection of unexpected risks: say, if an important set of Japanese investors bet too aggressively on the persistence of low long-term rates and face capital losses in their holdings of Japanese government bonds at the same time they are bleeding income on their hedged holdings of foreign currency bonds.

Geopolitical Risk

A new paper in the Journal of Portfolio Management, Comparing Geopolitical Risk Measures, documents that

measures based on asset prices reflect geopolitical risk changes more promptly than those based on textual analysis, whereas textual analysis–based measures incorporate new information on geopolitical risk more promptly than ratings-based ones.

The paper is paywalled, but Alpha Architect has a nice writeup on the findings.

Two Fed Board economists wrote a similarly titled paper, Measuring Geopolitical Risk, last March “present a news-based measure of adverse geopolitical events and associated risks.” But if the Journal paper is correct, this is a second-best solution.

Balding on RMB Displacing the Dollar

Balding has argued that we have a language problem when talking about the RMB replacing the dollar. He argues that we misconstrue the context and meaning when China says it is “internationalizing the RMB.”

It’s interesting, however, to think this through in terms of the X key areas laid out by Hyun Song Shin: invoicing, trade financing and hedging, investing and the depth of capital markets

The ‘internationalizing’ clearly changes invoicing. The invoicing of oil in RMB does not increase the depth of Chinese capital markets, so investing will remain USD-based. It may increase the RMB/$ hedging market if Balding is correct, to the extent the Saudi’s may swap back to dollar for investment.

Pettis on the RMB Displacing the Dollar

Pettis formally takes on the Poszar argument. He basically argues that dollar dominance will continue until the US decides it is not in its interest (which he hopes is soon). Key points:

Since the 1960s few arguments in international finance have been as exciting as "the coming demise of the dollar", but these arguments seem always to founder on the same set of mistakes.

The irony is that while Pozsar correctly notes that China's trade surplus is bigger than ever, he doesn't realize that this makes China even more dependent, and not less dependent, on the willingness of China and the rest of the world to hold dollars.

The key to global currency "domination" is … how willing they are to allow clear and transparent foreign ownership of domestic assets and, even more importantly, how willing and able they are to give up control of their capital and trade accounts. Beijing has made it clear it wants none of those things

[This] won't change until Washington itself takes much-needed steps to reduce the global role of the dollar.

China, Russia and Saudi Arabia … want a world in which they can maintain the very high trade surpluses that boost domestic growth and especially benefit the exporting elites within their domestic economies.

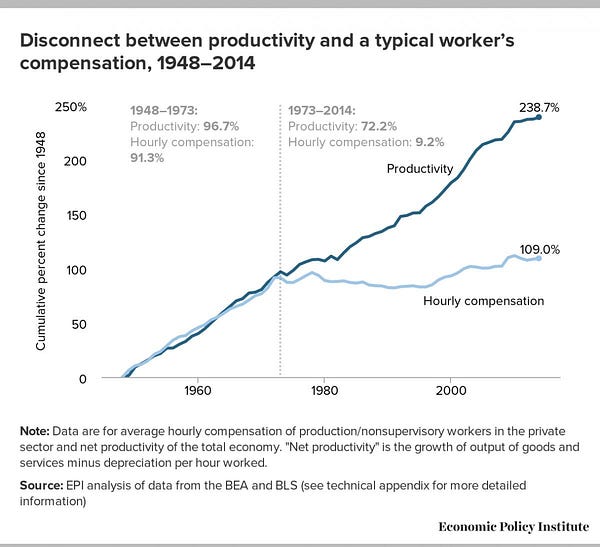

Productivity & Compensation

More on the Southwest SNAFU

The Stratergy substack had an interesting interview with the author of the Air Current blog. The conversation highlighted a few nuanced differences with my last writeup.

What ends up happening is, when you start to have cancellations, the airline systems have to adjust for what’s called irregular operations. So air airplanes aren’t where they’re supposed to be. Crews aren’t where they’re supposed to be. You’re trying to figure out where the operation is, what do you cancel, how do you do that? And there’s a whole set of different software tools that Southwest Airlines uses to do irregular operations. And they start with this tool called the Baker. That’s the one that generates various solutions for aircraft and passenger routings.

The Baker dumps its output into Sky Solver.

Ironically, Southwest’s attempt to simplify its operations by only flying one kind of aircraft made ‘solving’ the airplane/crew issue more complicated.

Southwest has always leaned on a single fleet of 737s as a hedge against the complexity that comes with its ascent to the nation’s largest domestic airline. Other airlines operate more aircraft than Southwest in aggregate, but each individual fleet type is its own smaller island on which to assign a specific cadre of pilots. By contrast, the unmatched scale of Southwest’s fleet, roughly 740 Boeing single aisles for 10,300 pilots and 17,000 flight attendants, is 60% larger than the next largest U.S. fleet, American Airlines Airbus A320 family.

So whereas other airlines must run optimizations on smaller batches of plane-type & crew, Southwest ends up with one giant optimization.

Given that you are increasing the number of variables, the complexity increases exponentially, not linearly, which means that Southwest, even if they were the most cutting edge in terms of software, which they’re I think generally not thought to be, was always the most susceptible to a disaster like this just because of the complexity that comes from that single fleet.

In addition, since other airlines operate from hubs, in a crisis they can ‘reboot’ by bringing all of the crews back to a hub to restart; Southwest can’t do this.

Simplicity in normal operations bred massive complexity in a crisis.

Cybersecurity Update

NIST is publishing this concept paper to seek additional input on the structure and direction of the Cybersecurity Framework (CSF or Framework) before crafting a draft of CSF 2.0. This concept paper outlines more significant potential changes that NIST is considering in developing CSF 2.0. These potential changes are informed by the extensive feedback received to date, including in response to the NIST Cybersecurity Request for Information (RFI) and the first workshop on CSF 2.0.

Haven’t read this (because I’m not personally interested) but worth making sure is on the right folks radar.

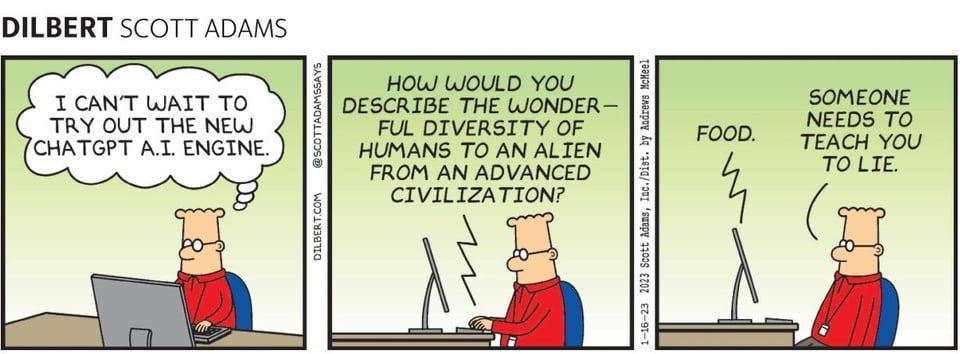

How To Use ChatGPT

You can add ChatGPT as a Chrome extension on your browser.

How to... use ChatGPT to boost your writing (One Useful Thing)

Some Insurance Things

Insurance supervision: 2023 priorities (Bank of England)

Smart Insurers Are Using AI to Power Distribution. Are You? (BCG)

Transforming claims and underwriting with AI (Accenture)

Machine Learning, AI Offer New Opportunities in Risk Management

Some Banking Things

Bank Regulator Weighs New Rules as Canada Housing Risks Rise (Bloomberg)

OCC Announces Deputy Comptroller for Systemic Risk Identification and Support

Why Banks Are Suddenly Borrowing From the Fed's Discount Window (OddLots)

On this episode of the podcast, we speak with Bill Nelson, chief economist at the Bank Policy Institute and a former employee of the Federal Reserve who helped design and manage the discount window for 10 years.

The Recent Rise in Discount Window Borrowing (Liberty Street)

So far in 2022, small banks generally appear to have continued to rely on FHLB borrowing to meet funding needs, as their FHLB borrowing has risen by approximately 20 percent to $183 billion relative to the prior year, according to the most recently available Call Report data. But with the elimination of the DW primary credit rate penalty and the availability of term DW loans, it appears that DW credit has become more competitive with FHLB term advances. This is particularly true for longer dated maturities of sixteen to ninety days that comprise close to half of the DW primary credit loans outstanding in recent months, according to Federal Reserve data.

Some Follow-ups on Past Perspectives

A Swing and a Miss - University of California's poor BREIT investment (Warden Capital)

While UC is effectively buying into BREIT at an implied discount - about a ~10% unlevered decline in prices, or a ~20% discount to NAV given BREIT’s approximately 51% leverage, it is not large enough.

Why Does Private Equity Get to Play Make-Believe With Prices? (Institutional Investor)

Building an AI governance strategy that works (Venture Beat)

The Extreme Shortage of High IQ Workers (Marginal Revolution)

This aligns with the Morris Chang speech discussed in the last Perspectives.

Chinese battery makers strengthen grip on global supply (FT)

Chinese battery manufacturers have extended their dominance over global supply, with the top two producers [CATL & BYD] reaching a combined market share of 50 per cent, and leaving South Korean and Japanese rivals lagging behind.

Tianqi Expands Lithium Empire With Deal to Buy Australian Miner (Bloomberg)

Federal Home Loan Banks are bailing out crypto (Protos)

The Federal Home Loan Bank (FHLB) system is suddenly finding itself bailing out numerous cryptocurrency-friendly banks, such as Silvergate and Signature. Estimates suggest they received over $15 billion in advances from the network combined.

polycrisis, Polycrisis, POLYCRISIS!

Presume you all know how I hate this jargon.

We’re in a new ‘polycrisis’ era and the World Economic Forum just warned us what to prepare for (Fortune)

I’ve generally found the WEF lists to be among the least useful of these lists.