Perspective on Risk - Feb. 3, 2023

Credit Boom of 2022; Small Banks; Stupid FX Tricks; CLO’s With Negative Consent Clauses; How Do Active Managers Invest?; More Productivity & AI; Fed Says No To Crypto; Correlation & Causation; Op Risk

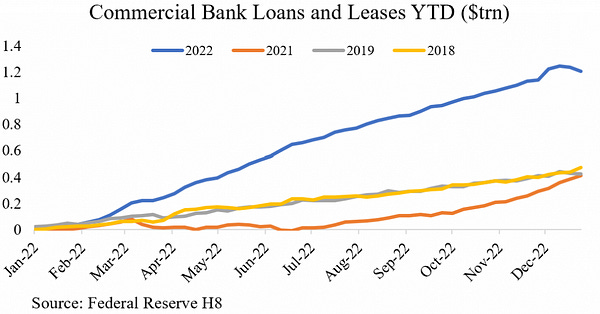

The Credit Boom of 2022

One of the leading indicators of banking sector stress is, ironically, overly fast credit extension. One year is not enough to cause a problem, though.

Closing The Barn Door

Commercial Real Estate

Global Property Market Faces $175 Billion Debt Spiral (Bloomberg)

“What we have in this downturn is a fairly unique set of economic circumstances. Interest rates are tightening instead of softening the blow for real estate and other corporates,” said Ian Guthrie, a senior managing director at the loan advisory team at Jones Lang LaSalle Inc., a real estate broker. “You have a pipeline of potentially defaulting loans” where “values are under pressure and cash flows are under pressure.”

The signs of a downturn are mounting in the US. But despite a dip, commercial property values “are still moderately overpriced,” said Michael Knott, head of US REIT Research at Green Street, who expects another 5% to 10% decline this year. “Appraisers are behind the curve, transaction activity has slowed down considerably.”

Distress levels in European real estate are at the highest in a decade, in part because of a decline in liquidity, according to a study by law firm Weil, Gotshal & Manges. UK commercial property values fell more than 20% in the second half of 2022, MSCI Inc. data show. In the US, the drop was about 9%, according to Green Street.

BREIT only met a quarter of January’s redemption requests (FT)

The $69bn Blackstone Real Estate Income Trust has just released its latest update on investor redemptions, and it looks like another $5.3bn requests for repurchases were submitted, but only $1.3bn will be allowed out.

In a statement to FTAV, Blackstone indicated that most of the January withdrawals were unfilled ones from previous months.

US Offices Reach 50% Occupancy for First Time Since Pandemic Hit (Bloomberg)

Paul Kedrosky shared some graphs

Leveraged Loans

Wall Street Rides Loan-Market Rally to Sell Risky Buyout Debt (Bloomberg)

As loan prices in the US and Europe stage a spirited rebound, global banks are managing to sell down small chunks of risky financing packages that powered debt-fueled acquisitions in the low-rate era.

There’s a long way to go before Wall Street manages to flog off the bulk of the risky loans and bonds left on their books to institutional investors — a burden that has clogged up the fee-rich M&A machine and changed the power dynamics in the risky lending market.

Small Banks - Reserves and Borrowing

We are highly unlikely to have a large bank problem again anytime soon; small banks may be another story.

Clearly, the recent uptick is [in Discount Window borrowing] dwarfed by the Covid-19 spike in 2020 (and by the surge in demand for liquidity at the peak of the financial crisis in 2008) but the shift is still intriguing.

The Recent Rise in Discount Window Borrowing (Liberty Street)

The notable decline in the total level of reserves in the banking system this year may have been an important factor for the rise in DW borrowing. Indeed, as the Fed has gradually shrunk its balance sheet, the cash balances of smaller institutions, particularly those with total assets less than $10 billion, have in aggregate declined sharply relative to their asset size, reducing their liquidity positions (see table below).

smaller banks are generally more willing to come to the DW than their larger counterparts, as they are usually not publicly traded companies and are less subject to public scrutiny. As shown in the table below, banks smaller than $3 billion in assets on average visited the DW twice as much as other banks in 2019, just prior to the pandemic.

with the elimination of the DW primary credit rate penalty and the availability of term DW loans, it appears that DW credit has become more competitive with FHLB term advances. This is particularly true for longer dated maturities of sixteen to ninety days that comprise close to half of the DW primary credit loans outstanding in recent months

Small Banks are Suffering from Rising Rates (WSJ)

Customers are pulling cash from bank deposits and investing in now-more-attractive U.S. Treasurys and money-market accounts. Small banks have been doubly hit by plunging securities portfolio values, putting them at risk of being unable to access low-cost funding from Federal Home Loan Banks, a critical source of liquidity.

As of September, 521 community banks—those with less than $10 billion in assets—have so-called tangible capital ratios below 5% of their total assets, according to the Kansas City Fed. The average community bank's ratio was at 10% or above for several years until 2022; just four banks sat below 5% at the start of last year.

Stupid Foreign Exchange Tricks

Just say no.

CLO’s With Negative Consent Clauses, and SOFR

Fed-Up CLO Investors Push Managers to Reject Terms of Benchmark Switch (Bloomberg)

some borrowers have been able to switch their existing loans to the Secured Overnight Financing Rate without including an adjustment blessed by industry officials that’s meant to compensate for the fact that SOFR consistently prints below Libor, allowing companies to reap significant savings at their expense.

The Alternative Reference Rates Committee, the Federal Reserve backed group in charge of overseeing the Libor transition in the US, recommended borrowers provide adjustments of 11 basis points and 26 basis points for loans tied to one- and three-month Libor, respectively.

CLO equity investors are especially frustrated by proposals tied to loans with so-called negative consent clauses, which comprise about 30% of the US leveraged loan market, according to Covenant Review data. Those clauses require more than half of creditors to actively vote to reject amendments in the span of five business days, in contrast to a typical loan where debtholders must vote yes for an amendment to pass and have longer to review the proposal.

How Do Active Managers Invest Their Own Money?

Active fund managers and the rise of Passive investing: epistemic opportunism in financial markets

Fascinating discussion this morning from Robin Powell. He points to a research note from Kings College where the authors surveyed active managers about how they were responding to the shift in favor from active to passive fund management over the past decade or two. But they also asked questions about how these managers invested their own monies.

Robin buries the lede in his discussion, but allow me to correct that oversight:

“Active managers invest their own capital passively.”

Many of the comments from active managers were eye-opening, but none more than “All my own money is in index funds” topped only by “I wouldn’t invest in my own fund.”

More Productivity & AI

Tyler Cowen recirculated this IMF paper from 2020: Will the AI Revolution Cause a Great Divergence? with this money conclusion:

This paper considers the implications for developing countries of a new wave of technological change that substitutes pervasively for labor. It makes simple and plausible assumptions: the AI revolution can be modeled as an increase in productivity of a distinct type of capital that substitutes closely with labor; and the only fundamental difference between the advanced and developing country is the level of TFP. This set-up is minimalist, but the resulting conclusions are powerful: improvements in the productivity of “robots” drive divergence, as advanced countries differentially benefit from their initially higher robot intensity, driven by their endogenously higher wages and stock of complementary traditional capital. In addition, capital—if internationally mobile—is pulled “uphill”, resulting in a transitional GDP decline in the developing country. In an extended model where robots substitute only for unskilled labor, the terms of trade, and hence GDP, may decline permanently for the country relatively well-endowed in unskilled labor.

Fed Says No To Crypto

Custodia is a special purpose depository institution, chartered by the state of Wyoming, which does not have federal deposit insurance. The firm proposed to engage in novel and untested crypto activities that include issuing a crypto asset on open, public and/or decentralized networks.

The firm's novel business model and proposed focus on crypto-assets presented significant safety and soundness risks. The Board has previously made clear that such crypto activities are highly likely to be inconsistent with safe and sound banking practices. The Board also found that Custodia's risk management framework was insufficient to address concerns regarding the heightened risks associated with its proposed crypto activities, including its ability to mitigate money laundering and terrorism financing risks.

If Correlation Is Not Causation, What Is It?

Operational Risk

Particle Physics Depends on Jos Vermaseren, Age 73

Crucial Computer Program for Particle Physics at Risk of Obsolescence (Quanta)

Maintenance of the software that’s used for the hardest physics calculations rests almost entirely with a retiree. The situation reveals the problematic incentive structure of academia.