Perspective on Risk - Feb. 16, 2023

Everything Old Is New Again; Related; Compensated For The Risk?; QE, QT, YCC and Liquidity; CLO Whale; A.I. Risk Management; Deriv. Clearing; OFR Report; Everybody Knows Occam’s Razor; Much More

Everything Old Is New Again

(Oh, Deutsche Bank - Not Again)

Those who know me back from the Fed days, and maybe some of you readers, will remember the Bankers Trust Leveraged Derivatives Trading scandal. It was a formative time of my career. Marketers were ripping off their customers, traders were ripping off the marketers, management was pushing for volume. Ultimately, the Fed issues a Written Agreement and subsequent Cease-and-Desist Order to BT, and BT was sold to Deutsche Bank as part of their expansion into the US. Anyway …

Deutsche Bank Probe Says Staff Deliberately Mis-Sold Derivatives

An internal review at Deutsche Bank AG found that some employees deliberately circumvented controls to make big profits by mis-selling products.

The probe known as Project Teal showed that some employees on a London-based foreign-exchange desk sold derivatives to small and medium-sized Spanish companies even though they knew that the products were too complex for those clients, according to people familiar with the matter.

[In the BT LDT days it was some US companies, such as Gibson Greetings, Air Products and Proctor & Gamble, and a number of Indonesian banks and insurance companies . All this was in pre-internet days, so there’s not a lot of good links.]

Deutsche Bank has been looking at dozens of deals in Spain for more than two years after clients started complaining that derivatives sold to them as cheap hedging products blew enormous holes into their bottom lines when exchange rates took an unexpected turn.

[In the BT case, the deals involved structures with embedded derivatives. Ove time, as losses occurred, these transactions would get restructured into even more leveraged trades. And in each case the marketers and traders would take out more vig.]

The German lender is also contesting some cases, notably a claim of €500 million ($534 million) by Palladium Hotel Group. The Spanish company has filed a lawsuit alleging that it entered into hundreds of “highly complex” foreign-exchange transactions that were “impossible” for Palladium to price, value or understand the risks and ultimately lead to huge losses.

[There was no standard reporting of MTM, and the marks provided to the clients were not at levels that BT would actually be willing to transact.]

Other banks including Goldman Sachs Group Inc. and BNP Paribas SA have faced similar accusations of mis-selling derivatives in Spain, with wine exporter J. Garcia Carrion SA filing a complaint against Goldman with the UK’s Financial Conduct Authority in 2021.

[The 1990s were a time filled with these types of frauds; eventually the banks got their acts together, but not until there were lots and lots of losses and regulator pressure.]

Of course, DB is not alone. BNP under fire from Europe’s top wine exporter over lossmaking forex trades

J. García Carrión, founded in Jumilla in south-east Spain in 1890, is in dispute with the French lender over currency transactions with a cumulative notional amount of tens of billions of euros.

Separately, the Spanish wine producer is suing Goldman Sachs in London’s High Court for a partial refund of $6.2m of losses caused by exotic currency derivatives.

[The Goldman response is the proper defense. In the consumer world, banks must be careful that an investment meets a suitability test. In the corporate world, the dealers have all instituted ‘appropriateness’ policies. This gets more nuanced. Did you market the trade as a hedge when it was a punt? Did you illustrate the outcomes appropriately? Were you dealing with an individual with the sophistication to understand the transaction, and when it went south and needed restructuring, did you elevate the conversation with the client?]

Now, the German regulator has a similar requirement about evaluating customer’s sophistication. From Handelsblatt’s Were the investment bankers selling inappropriate products? Deutsche Bank initiates internal investigation

The securities directive Mifid forces banks to sort their customers into different risk categories depending on their expertise. Customers must sign this classification. This classification determines which products may be sold to this customer. The more inexperienced a customer is, the simpler and more understandable the products must be.

The FT has a few classic comments on the DB FX trading.

Deutsche Bank told the FT in a statement that it took “appropriate action” after it reviewed “parts of our sales activities in structured FX derivatives”, adding that it was “improving our processes and enhancing our controls”.

Of course

The ECB and German regulator BaFin declined to comment.

But

A second person familiar with the probe [likely a UK regulator] described some of the Deutsche staff conduct as “very unfortunate”.

LOL.

Related: Trust, Transparency, and Complexity

Robert Merton wrote a post for the Harvard Law School Forum on Corporate Governance where he summarizes a forthcoming paper Trust, Transparency, and Complexity.

In recent years, there has been increasing complexity in both physical and financial products, due to higher demand for customization and financial innovation. Customers—who may have trouble understanding all relevant product attributes—have to trust the producers in order to buy their products, and investors have to trust these producers in order to invest in them.

Despite this common view that transparency can help build trust in product sellers, thereby helping buyers cope with complexity, the empirical evidence on the issue is mixed—there is little direct causal evidence on the relationship between transparency and trust in the cross-section. Indeed, anecdotal evidence suggests that greater transparency need not be associated with greater trust: This may be true even when there is a benevolent regulator overseeing a monitor (like a bank) with reputational concerns.

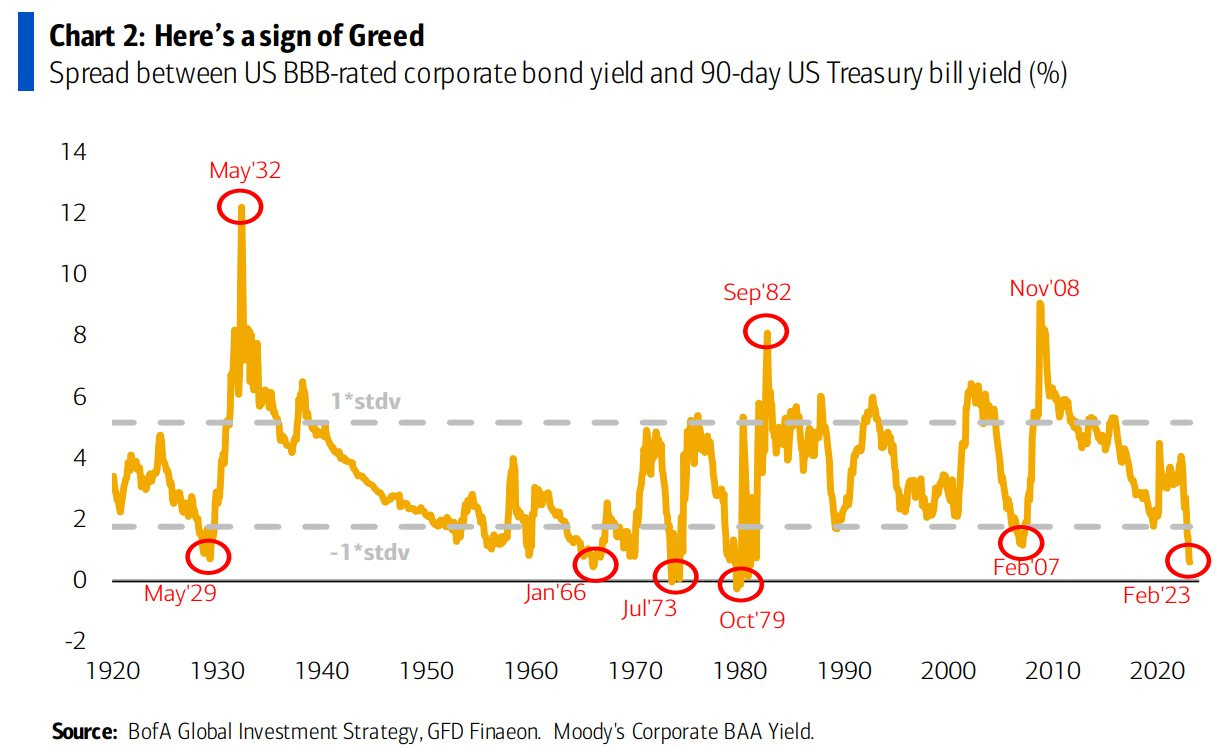

Are You Getting Compensated For The Risk?

Those spreads look pretty tight, particularly if there is a heightened chance of a recession.

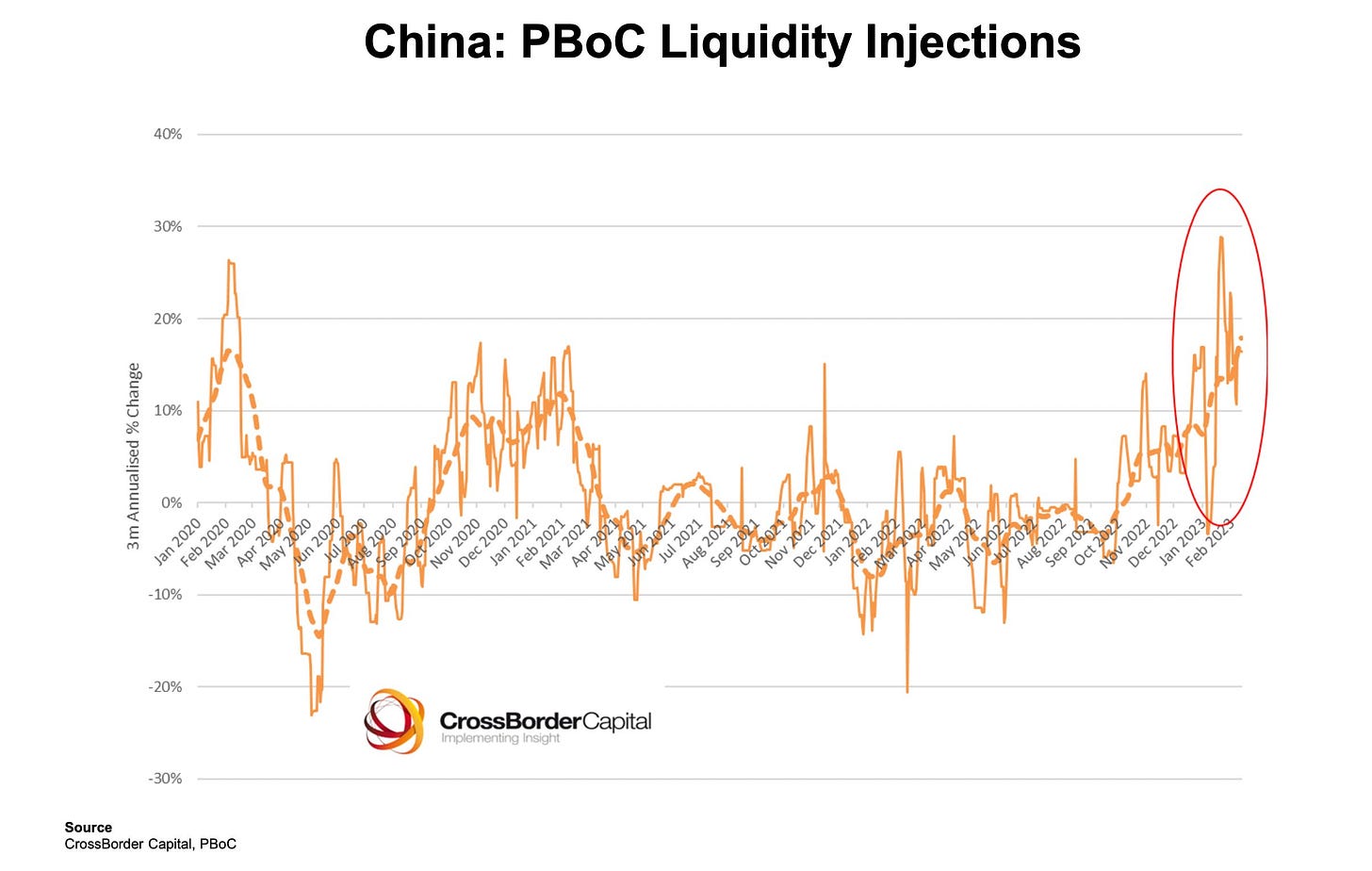

QE, QT, YCC and Liquidity

While the Fed is reportedly in the process of withdrawing dollar liquidity, there are some that are asserting that this retrenchment is being more than offset by the actions of the Bank of Japan and People’s Bank of China. May explain tight spreads and increasing equity prices. Should also lead to continued USD strength.

BoJ YCC > Fed QT (FT)

BoJ purchases of JGBs to keep yields low are now bigger than Fed QT, and the result is that central banks are once again adding liquidity to global financial markets, which was likely contributing to the rally in equities and credit in January. With YCC still in place in Japan, QE will continue to support global financial markets.

This above comes to us from Apollo’s chartmeister (and chief economist) Torsten Sløk, and shows how the Bank of Japan is now buying so many bonds to defend its yield ceiling that its counteracting all the balance sheet shrinkage by the Fed, BoE and ECB.

CLO Whale Is Back

Is the CLO whale back in the water?

Norinchukin Bank is preparing a return to the global CLO market, Bloomberg reported last week.

If these buyers were to re-enter the market, and for now we would assume it would be in smaller size than in 2017, then that could create a very interesting technical for AAA CLO spreads to rally further. Unintentionally, that could create good support for leveraged loan prices and corporate funding costs, which could in turn result in more older CLOs being refinanced in the next two years, a big potential boost to mezzanine CLO bondholders as most of these bonds are still trading at significant discounts to par.

A.I. Risk Management

If you are a financial risk manager, here is a new ‘must read’ document. NIST generally publishes the best information in the space.

Artificial Intelligence Risk Management Framework (AI RMF 1.0) (NIST)

While there are myriad standards and best practices to help organizations mitigate the risks of traditional software or information-based systems, the risks posed by AI systems are in many ways unique (See Appendix B).

AI systems, for example, may be trained on data that can change over time, sometimes significantly and unexpectedly, affecting system functionality and trustworthiness in ways that are hard to understand.

AI systems and the contexts in which they are deployed are frequently complex, making it difficult to detect and respond to failures when they occur.

AI systems are inherently socio-technical in nature, meaning they are influenced by societal dynamics and human behavior.

AI risks – and benefits – can emerge from the interplay of technical aspects combined with societal factors related to how a system is used, its interactions with other AI systems, who operates it, and the social context in which it is deployed.

I don’t have the proper incentive to read this in detail anymore (but what I’ve read indicates it is quite good), but if one of you have someone go through this and think you have insight to share, I’d be happy to give you a platform.

Brookings has a nice overview: NIST’s AI Risk Management Framework plants a flag in the AI debate

Derivative Clearing

Cyberattack Sends Derivatives Trading Back to the 1980s (Bloomberg)

Derivatives shops, used to clearing hundreds of billions of dollars in trades every day, found themselves in a dramatically different era this week: the old days of manually processing deals.

Early Tuesday morning in Europe, a little known but critically important software company that underpins the smooth functioning of stock, bond and commodities markets started to seize up. London-based ION Trading UK had succumbed to a cyberattack.

For the derivatives market, it was a slap in the face. Not only did companies lack adequate staff to meet the crisis, but many of the workers were too young to know how to keep operations afloat.

The outage, which is still ongoing, affected vital processes including the matching of trades, the calculation of margin calls and regulatory reporting on large market positions. That left many clients in the dark about whether they were making or losing money, and prompted calls for more collateral, the people said.

[To this last point, one lesson I learned from the 9-11 attack is that sometimes the value of providing information is the critical aspect. On 9-11, BNY had a link between two systems severed that prevented them from providing clients with information on which trades had cleared and which hadn’t - this was a big deal.]

Hack of ION Derivatives System Prompts Caution in Other Markets (Bloomberg)

A cyberattack in a little-known corner of the derivatives market has Wall Street’s biggest trading desks treading carefully in other markets unscathed by the incident, a sign of jitters pulsing through an industry on watch for such attacks.

OFR Annual Report

The US Office of Financial Research issued their annual report. Overall, the conclusions are anodyne and pretty much reflect consensus. They seem to be more concerned about insurance companies than banks or hedge funds, citing these four issues that they do not differentiate among different types of insurers:

Changes in insurers’ investment policies as interest rates rise and fall.

Rising claim costs due to inflation.

Increased life sector involvement by private equity–affiliated insurers.

The increasing stress on the ability of the private insurance industry to cover large and growing risks.

meh.

An incredibly sanguine report for one that should be highlighting risks.

Everybody Knows Occam’s Razor

Although Sid and I always liked Hanlon’s razor.

Mark-To-Nothing

I’m Available To Fill These Positions

Podcast

What Zillow Knows About the Housing Market in 2023

The Zillow guys talk to the Argus Research folks; two of the better commentators. The above link will take you to a video; here is a direct Spotify link for those who consume this way.